Introduction: A New Financial Paradigm

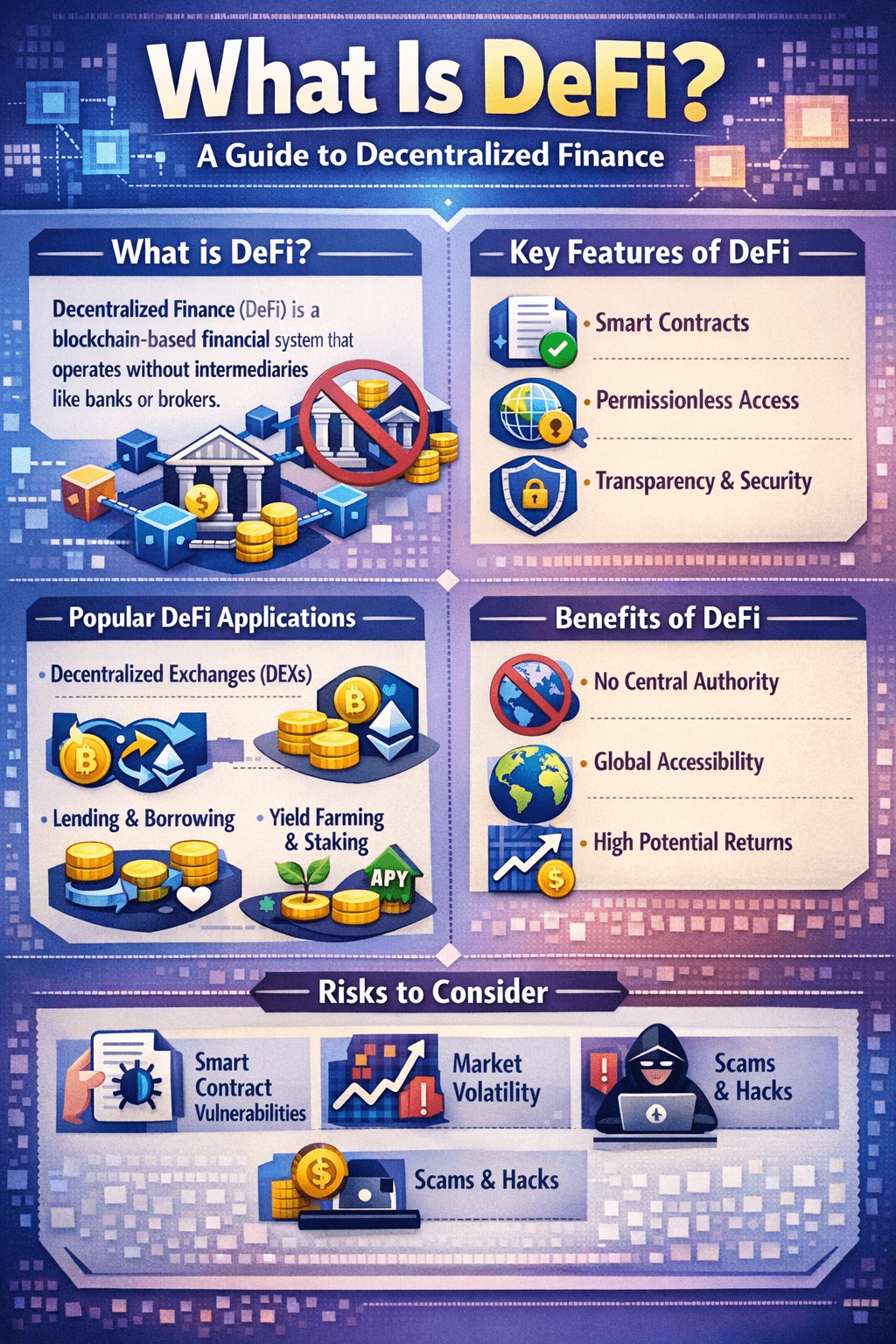

Decentralized Finance, commonly called DeFi, is a transformative financial system built on blockchain technology. Its core proposition is to recreate and reimagine traditional financial services—like lending, borrowing, and trading—without relying on centralized intermediaries such as banks or brokerages. By using self-executing smart contracts on public ledgers, DeFi aims to create an open, permissionless, and transparent financial ecosystem. Understanding what DeFi is and how it works is crucial for anyone navigating the future of digital assets and global finance.

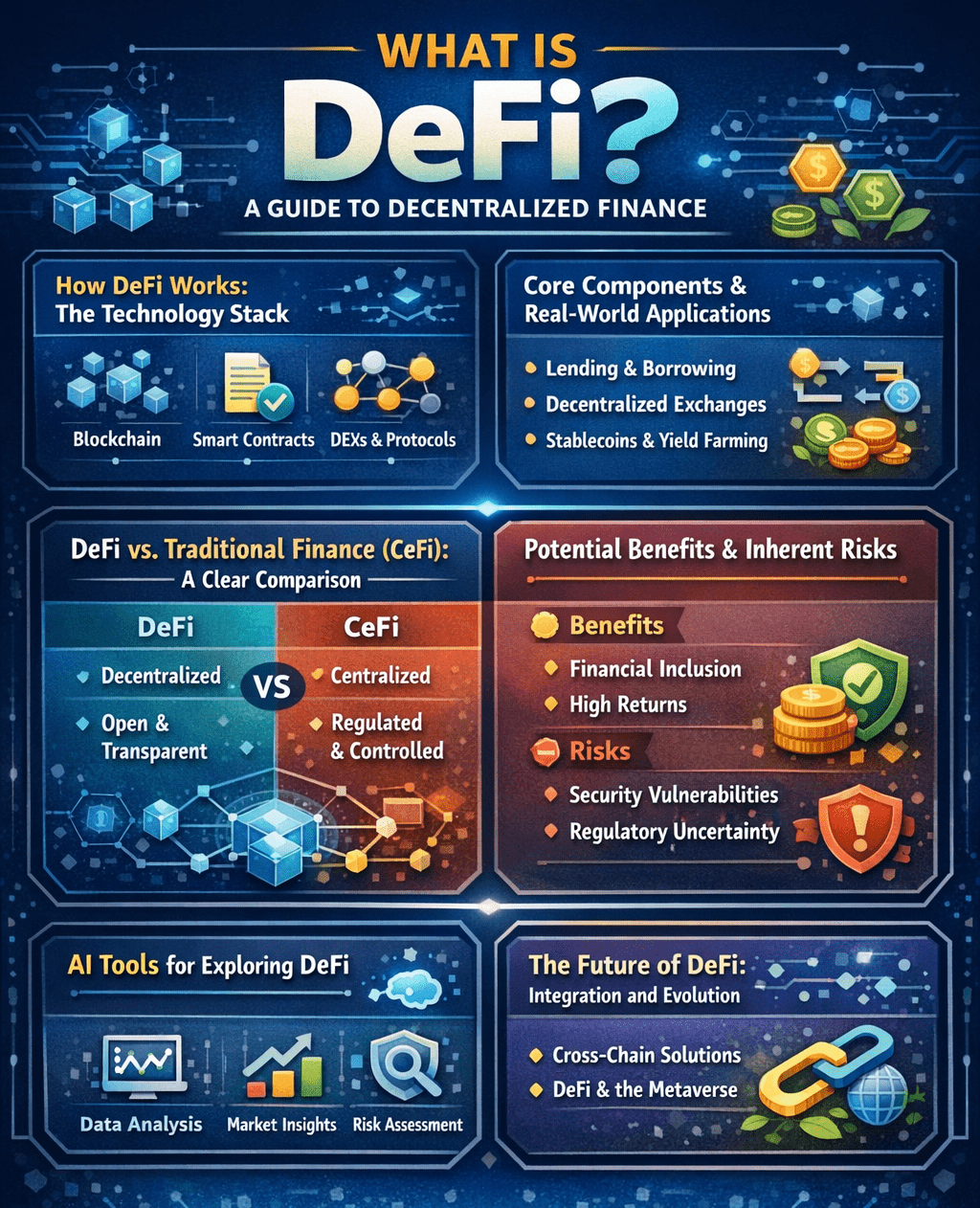

How DeFi Works: The Technology Stack

DeFi operates on a layered technological stack, often conceptualized as a three-layer model: settlement, application, and interface.

- The Settlement Layer: This is the foundational blockchain (like Ethereum), which provides the secure, immutable ledger for recording transactions and asset ownership.

- The Application Layer: Here, smart contracts—programmable codes that automatically execute agreements—create the protocols for specific financial services. These are the decentralized applications (dApps) users interact with.

- The Interface Layer: These are the user-friendly front-ends (websites or apps) that connect individuals to the complex smart contract logic operating beneath.

This stack enables a shift from institution-based trust to technology-based trust, where code mediates transactions.

Core Components and Real-World Applications

DeFi isn’t a single product but an ecosystem of interoperable protocols. Key components include:

- Decentralized Exchanges (DEXs): Platforms like Uniswap allow peer-to-peer crypto trading without a central authority, using liquidity pools instead of traditional order books.

- Lending & Borrowing Protocols: Platforms such as Aave and Compound let users lend crypto assets to earn interest or borrow against their holdings. Loans are typically over-collateralized to manage risk in volatile markets.

- Stablecoins: These are cryptocurrencies pegged to stable assets like the US dollar. They are essential for reducing volatility within DeFi and come in various forms, including fiat-collateralized (USDC, USDT) and algorithmic models.

- Yield Farming and Staking: Users can generate passive income by providing liquidity to protocols or participating in network security, often earning rewards in the protocol’s native token.

DeFi vs. Traditional Finance (CeFi): A Clear Comparison

The difference between DeFi and Centralized Finance (CeFi) is structural and philosophical.

| Feature | Decentralized Finance (DeFi) | Traditional / Centralized Finance (CeFi) |

| Control & Custody | Users hold their own private keys and maintain direct control of assets. | Institutions (banks, brokers) custody assets on behalf of users. |

| Access | Permissionless; accessible to anyone with an internet connection. | Requires identity verification (KYC) and account approval. |

| Transparency | Transactions are public and verifiable on the blockchain. | Transactions are private, with limited visibility into institutional ledgers. |

| Intermediaries | Eliminates or reduces intermediaries via smart contracts. | Relies entirely on intermediaries (banks, clearinghouses, legal systems). |

| Operational Hours | 24/7/365. | Limited to business hours and days. |

| Regulation | Operates in a largely unregulated or evolving regulatory space. | Heavily regulated with established consumer protections. |

In essence, while a traditional bank acts as a trusted third party to manage and facilitate transactions, a DeFi protocol replaces that role with code. One industry expert notes that DeFi replaces trusted intermediaries with blockchain-based smart contracts.

Potential Benefits and Inherent Risks

Benefits:

- Accessibility and Financial Inclusion: DeFi can provide services to the unbanked or underbanked globally.

- User Control and Autonomy: Individuals have sovereign control over their funds without requiring permission.

- Transparency and Auditability: Every transaction is permanently recorded on a publicly accessible ledger, enabling independent verification.

- Innovation and Composability: DeFi protocols are like “money legos,” designed to be interconnected, enabling rapid innovation of complex financial products.

Significant Risks:

- Smart Contract Risk: Code vulnerabilities or bugs can be exploited by hackers, leading to irreversible fund losses.

- Regulatory Uncertainty: The lack of clear regulation means few consumer protections exist if transactions go wrong.

- Counterparty and Scam Risk: The anonymous nature can mask fraudulent actors. Regulatory bodies warn investors to be wary of offers that seem too good to be true.

- Technical Complexity and Volatility: User error (like losing a private key) is permanent. Coupled with high asset volatility, this creates a risky environment where you can lose more than you invest.

Given these risks, a cardinal rule in DeFi is never invest more than you can afford to lose.

AI Tools for Exploring DeFi

To understand and manage DeFi effectively, several AI-powered tools can help:

- Crypto Portfolio Trackers: Use AI to analyze portfolio performance and risk.

- Market Sentiment Analysis: AI monitors social media, news, and trading trends to predict market movements.

- Smart Contract Auditing Tools: AI assists in identifying vulnerabilities in DeFi contracts.

- Chatbots for DeFi Guidance: AI chatbots provide real-time assistance and explanations of DeFi protocols.

The Future of DeFi: Integration and Evolution

The trajectory of DeFi points toward greater integration with traditional finance (TradFi) as institutions explore blockchain efficiency. Future developments will likely focus on solving current challenges:

- Scalability: Layer-2 solutions aim to reduce high transaction fees and network congestion.

- Interoperability: Cross-chain bridges seek to connect disparate blockchains for a more cohesive ecosystem.

- Maturing Regulation: Evolving regulatory frameworks will aim to protect consumers while fostering innovation, potentially bringing more stability to the space.

Conclusion

DeFi represents a fundamental re-architecting of financial systems, shifting trust from institutions to transparent, auditable code. While it offers a compelling vision of an open and accessible global financial market, it remains a nascent field fraught with technological, economic, and regulatory risks. Its future will be shaped not by replacing traditional finance, but through a complex process of coexistence, challenge, and integration. For the informed participant, continuous education and rigorous due diligence are non-negotiable prerequisites.

FAQs

Do I need a bank account to use DeFi?

No. You only need a cryptocurrency wallet and an internet connection to access DeFi protocols, which is a key feature for promoting global financial inclusion.

Can I get an uncollateralized loan in DeFi?

Typically, no. Most DeFi loans require over-collateralization with other crypto assets to mitigate the risk of price volatility and default. Special mechanisms like flash loans are the exception but must be repaid within a single blockchain transaction.

Is investing in DeFi safer than traditional banking?

No, it is significantly riskier. DeFi operates with minimal regulatory oversight, lacks deposit insurance, and exposes users to smart contract failures, scams, and extreme asset volatility, unlike the protected, regulated traditional banking system.