AI-Powered Stock Market: The Financial Analysis Revolution

Introduction

The architecture of the global AI-Powered Stock Market is undergoing a foundational transformation, driven by the pervasive integration of AI-Powered Stock Market. This shift represents far more than mere automation; it is a complete re-engineering of financial analysis, risk management, and execution. This revolution enables data-driven decision-making at millisecond speeds, fundamentally altering market dynamics. However, it’s ultimate test—and most profound application—lies in navigating the volatile landscapes of political instability and economic uncertainty. This analysis deconstructs how AI-Powered Stock Market is engineered not just for efficiency and prediction, but for resilience, surveillance, and strategic foresight, establishing a new paradigm for the augmented financial strategist.

AI-Powered Stock Market: The Financial Analysis Revolution

Overview of the AI Bubble Phenomenon

The AI bubble stock market refers to the growing concern that artificial intelligence–focused companies are experiencing inflated stock valuations driven by speculative investment rather than proportional financial performance. This theory has gained traction amid rapid advancements and widespread adoption of AI technologies across industries.

Surge in Artificial Intelligence Investment

Massive capital inflows into AI infrastructure, research, and development have fueled extraordinary growth expectations. Cloud computing expansion, large-scale AI models, and semiconductor demand have positioned AI firms as central drivers of market momentum.

Circular Investment and Valuation Inflation

A key concern behind the AI bubble narrative is the circular flow of investments among major technology firms. Strategic cross-investments, cloud service dependencies, and ecosystem partnerships can magnify revenue figures, creating the appearance of accelerated growth without independent market validation.

Economic Influence Beyond Market Speculation

Unlike historical speculative bubbles, AI is already delivering measurable productivity improvements. Automation, predictive analytics, and decision intelligence are enhancing operational efficiency across finance, healthcare, manufacturing, and digital services.

Comparison With Historical Technology Bubbles

The AI bubble debate is frequently compared to the dot-com era. However, AI differs in that it is deeply embedded in enterprise systems, government infrastructure, and consumer applications, making a complete market collapse less likely despite potential valuation resets.

Long-Term Outlook for AI in Capital Markets

The future of the AI bubble stock market lies in balance. While speculative excess may exist, artificial intelligence is positioned as a foundational technology. Market recalibrations may occur, but AI-driven innovation is expected to remain a long-term growth engine.

The Core Engine: AI’s Foundational Mechanisms & Key Applications

The Core Entity: AI-Driven Quantitative Models

The primary entity is the ecosystem of AI quantitative models. These are not simple tools but complex ensembles—including neural networks and NLP—designed to process structured and unstructured data. They identify non-linear patterns for ROI analysis, dividend sustainability modeling, and market cycle analysis, moving far beyond traditional analytical capabilities.

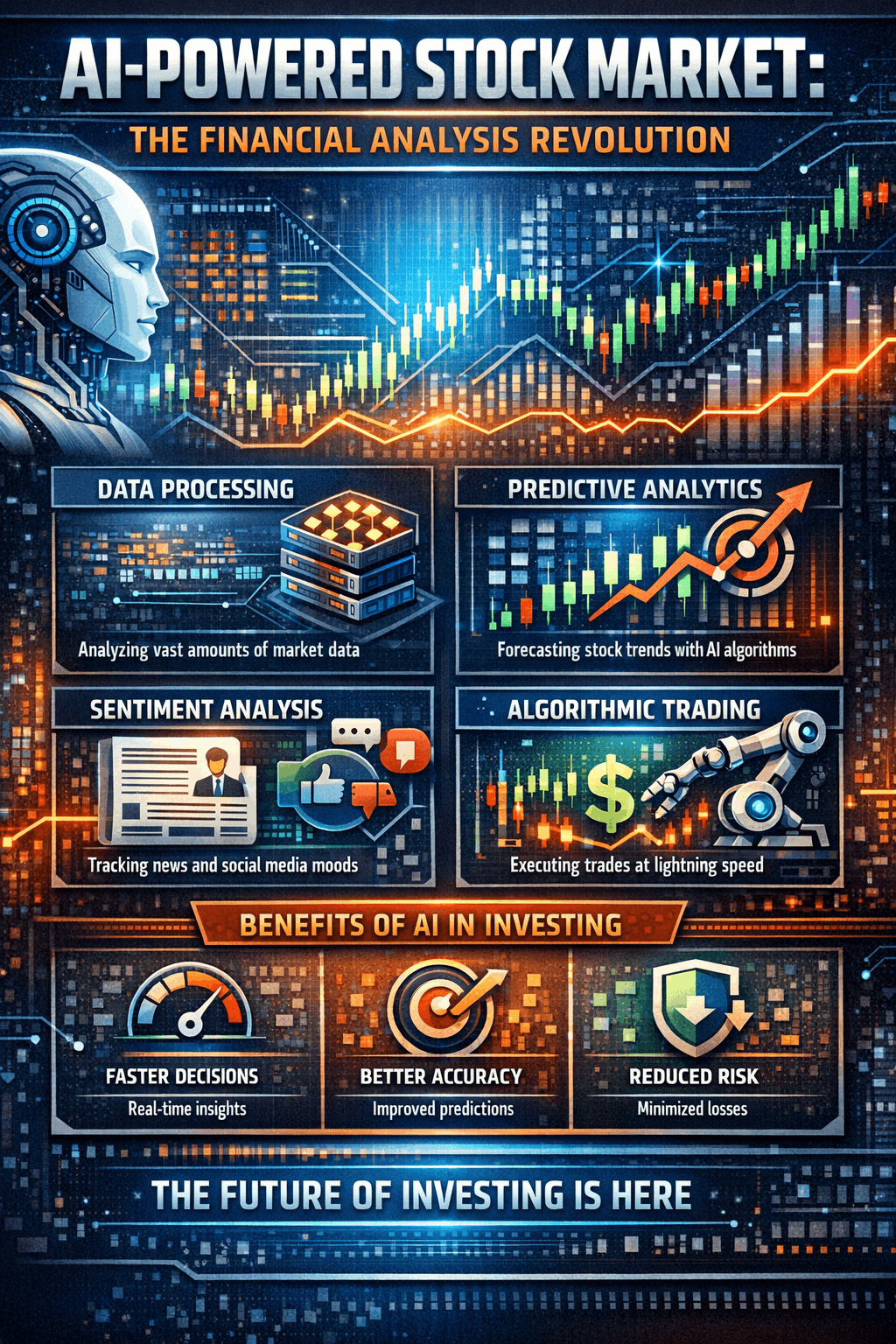

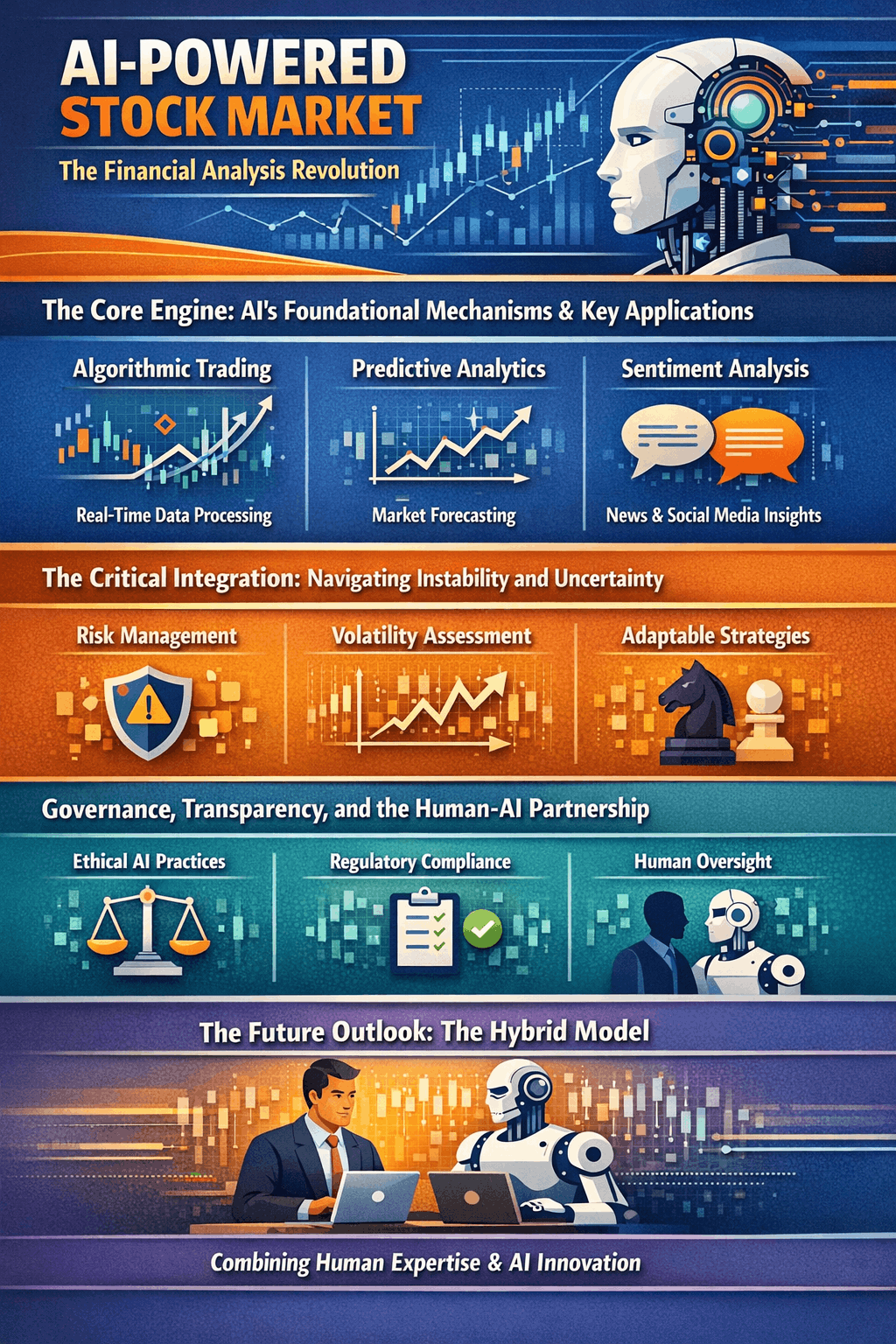

Algorithmic and High-Frequency Trading (HFT)

AI powers algorithms that execute trades in milliseconds based on pre-defined rules and real-time data, capitalizing on microscopic price discrepancies. This application underscores the dual nature of AI: enabling immense efficiency and liquidity while introducing risks of amplified volatility, as seen in historical flash crashes exacerbated by algorithmic feedback loops.

Predictive Analytics and Financial Forecasting

Machine learning models analyze historical data, financial reports, and macroeconomic indicators to forecast price movements and identify trends. This transforms investment theses from speculative bets into probabilistic simulations, though a critical limitation remains the models’ inherent reliance on historical data patterns.

Sentiment Analysis via Natural Language Processing (NLP)

AI scans news articles, social media, and earnings calls to gauge market sentiment. This capability is crucial for integrating the impact of news and public perception—key drivers during periods of political instability and uncertain circumstances—directly into trading and risk models.

Portfolio Management, Optimization & Robo-Advisors

AI-driven systems and robo-advisors optimize asset allocation based on risk tolerance and goals, running millions of simulations. They provide 24/7 management and rebalancing, democratizing access to sophisticated portfolio strategies while operating within the constraints of their underlying algorithms.

Risk Management, Fraud Detection & Market Surveillance

AI continuously monitors for unusual patterns, market manipulation, and operational risks. Regulatory bodies like the SEC and exchanges like Nasdaq deploy AI for surveillance, automating compliance and helping ensure market integrity—a non-negotiable function in maintaining trust during volatile periods.

The Critical Integration: Navigating Instability and Uncertainty

Geopolitical Risk and Adaptive Sentiment Analysis

During instability, NLP tools are tuned to parse official statements, policy shifts, and conflict-related news. This real-time sentiment analysis feeds directly into volatility models, allowing for the pre-emptive stress-testing of portfolios against potential political shocks before they fully materialize.

Regulatory Change Forecasting and Compliance Automation

Political change begets regulatory risk. AI monitors legislative and central bank communications to forecast the impact of new rules. This transforms compliance from a reactive cost into a strategic input, allowing firms to adapt their strategies proactively rather than defensively.

Advanced Scenario for “Black Swan” Events

Beyond standard models, AI generates thousands of bespoke, low-probability crisis scenarios (e.g., capital controls, regional conflicts). The goal is not to predict the specific “black swan” but to understand portfolio vulnerabilities and ensure liquidity and hedging strategies are robust across all uncertain outcomes.

Real-Time Economic and Supply Chain Monitoring

Instability disrupts fundamentals. AI uses alternative data—satellite imagery, shipping traffic, global supplier sentiment—to model economic activity in near-real-time. This provides a ground-truth assessment of how geopolitical decisions directly impact corporate earnings and dividend safety for multinational firms.

Sovereign and Counterparty Risk Reassessment

AI enables the continuous, dynamic monitoring of sovereign credit risk and the financial health of banks and brokers. By analyzing debt levels, CDS spreads, and political risk scores, systems can automatically adjust exposure limits to mitigate counterparty failure risk during a systemic crisis.

Governance, Transparency, and the Human-AI Partnership

Explainable AI (XAI) for Accountability and Trust

The “black box” problem is a major risk. XAI techniques are being developed to make AI decisions interpretable, allowing systems to articulate why a trade or hedge was executed. This transparency is critical for building trust with clients and satisfying regulatory scrutiny during and after market turmoil.

Automated, Rules-Based Crisis Response Frameworks

For extreme volatility, AI can execute predefined, human-approved protocols (e.g., automatic circuit breakers, hedging triggers). This balances the need for millisecond response with strict governance, preventing emotional decisions and containing losses during events like flash crashes.

Behavioral Bias Detection in Human Overseers

AI can reflexively monitor its human operators. By analyzing decision patterns and communications, it can flag behavioral biases like panic or herding that are amplified during uncertainty, providing a crucial safety net against human error under stress.

The “Red Team” Challenge: Mitigating Historical Bias

A core vulnerability is AI’s dependence on past data. A mandatory strategic practice is adversarial “Red Team” testing, where a separate model actively works to generate plausible shock scenarios that break the primary model’s assumptions. This continuous stress-testing is essential to avoid overconfidence in outdated patterns.

Analysis: Weighing the Benefits against Inherent Risks

| Aspect | Benefits & Strategic Advantages | Risks & Critical Limitations |

| Speed & Efficiency | Analyzes vast datasets and executes trades in fractions of second, improving market liquidity and capitalizing on short-lived pricing opportunities. | Can amplify market volatility; a single error can cascade (e.g., 2010 Flash Crash). Software integrity is paramount. |

| Decision-Making | Eliminates emotional bias (fear, greed), enforcing disciplined, data-driven strategies. | Over-reliance on historical data; may fail in unprecedented events (“black swan” scenarios). |

| Analytical Depth | Uncovers complex, non-linear patterns in vast datasets beyond human capability, enhancing predictive analytics. | “Black box” opacity in complex models challenges transparency, auditability, and trust. |

| Risk & Surveillance | Enables 24/7 monitoring, real-time fraud detection, and sophisticated compliance automation. | Creates cybersecurity vulnerabilities; sophisticated AI itself could be weaponized for market manipulation. |

| Strategic Foresight | Powers advanced scenario testing and adaptive modeling for geopolitical and regime-shift risks. | Requires impeccable, curated data; outcomes are only as good as the data and parameters fed into the system (“garbage in, garbage out”). |

The Future Outlook: The Hybrid Model

The trajectory points toward deeper integration of explainable AI (XAI) and generative AI for simulating complex market environments. The future is a hybrid model: AI acts as an unparalleled decision-support system, processing complexity and identifying signals, while human experts provide ethical judgment, strategic oversight, and manage exceptions. This partnership is essential for navigating the inherent uncertainties of global markets.

AI-Powered Stock Market: The Financial Analysis Revolution

Conclusion: The Imperative of Augmented Intelligence

The integration of AI in the Stock Exchange marks a decisive evolution from qualitative finance to quantitative strategic science. Its power in ROI and dividend analysis provides depth; its capacity for market fluctuation analysis provides discipline. Yet, its most significant role is serving as a strategic context engine for an age defined by political instability and uncertain circumstances. By systematically converting volatility and chaos into navigable scenarios and probabilistic insights, AI empowers the human expert. The goal is not autonomous trading machines, but augmented intelligence—a synergistic partnership where human wisdom directs computational power to make more informed, resilient, and accountable financial decisions for the complex world ahead.

FAQs

Can AI truly predict stock market crashes or “black swan” events?

No, AI cannot predict specific unprecedented events. However, robust AI systems are continuously stress-tested against a vast spectrum of extreme, low-probability scenarios. This process ensures portfolios have structural buffers, dynamic hedges, and liquidity plans that provide resilience even when the exact catalyst is a surprise.

How can investors trust AI “black box” decisions with their money?

Trust is built through governance, not opacity. Leading frameworks mandate the use of Explainable AI (XAI) techniques, require clear human oversight protocols, and involve rigorous third-party model validation. Investors should seek providers who transparently explain their AI’s logic, limitations, and crisis response plans.

Will AI eventually replace human fund managers and analysts entirely?

Replacement is unlikely; augmentation is inevitable. AI excels at data processing, pattern recognition, and executing defined rules at scale. Human professionals excel at strategic synthesis, ethical reasoning, and navigating genuinely novel situations. The future belongs to augmented strategists who skillfully wield AI as a powerful tool within a broader framework of human judgment.